Africa is one of the most vulnerable regions to the impacts of climate change (African Development Bank Group, COP 25, December 2019) despite having relatively low contributions to global emissions. It faces huge collateral damage posing substantial risks to its economies, food systems, and livelihoods. Important challenges that African countries face from climate change include:

- the impact on food security and livelihoods from reduced agricultural production and productivity

- the limited access to capital, technology and skills for economic adaptation and transition

- limited governance and institutional capacity to deal with conflict over scarce resources and displacements arising from extreme climate events

While these challenges are severe, African countries have an opportunity to be an important part of the solution to the climate change challenge and contribute towards global Net Zero. This can be through unlocking the potential of renewable energy, climate smart agriculture and smart manufacturing, for instance. The UK, as a leading provider of green products and services, is in a strong position to help Africa seize the opportunity to build sustainable, green, inclusive and resilient businesses to drive the transition, which has become increasingly important in the context of climate change.

Green businesses do not contribute any negative impact on the environment, economy, or community. They use environmentally sustainable resources and uphold socially responsible policies (Harvard Business School, what does “sustainability” mean in business? October 2018).

Supporting the growth of such businesses has the potential to drive the creation of climate-smart jobs, boost economic growth and achieve sustainable development.

This short Growth Gateway project considered 8 topic areas and more than 30 sub-sectors within the broader green business space. Three dimensions were used to select focus sub-sectors:

- Africa structural advantage: is commercial potential on the continent already proven, or are the right conditions in place?

- UK comparative advantage: do UK firms have a strong right-to-play and right-to-win?

- impact potential: what is the potential environmental, social and economic impact?

Green trade and investment opportunities

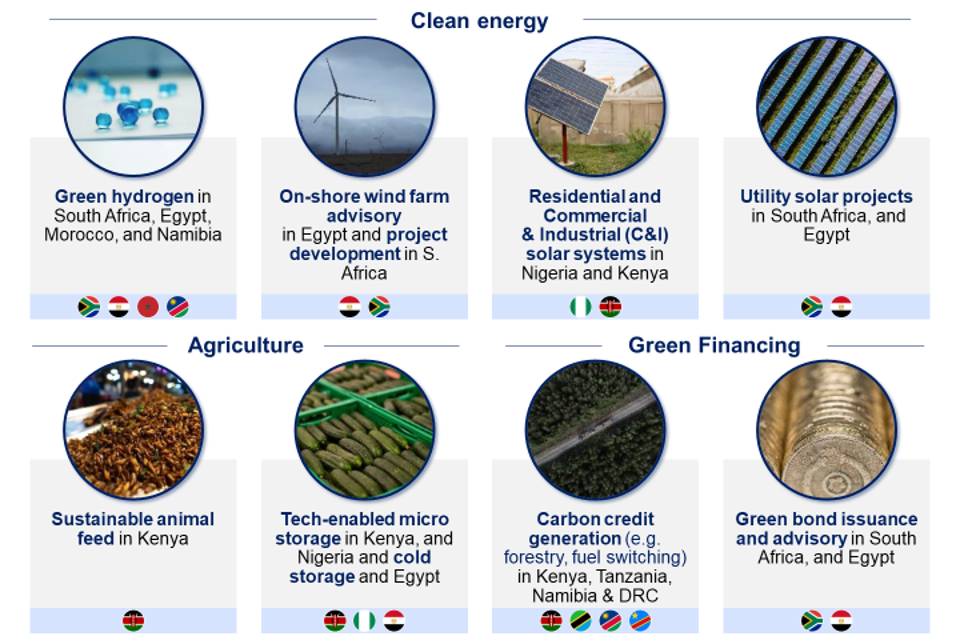

From this overall landscape of over 50 opportunities, the project identified 8 high potential areas that have the clearest potential for UK-Africa trade and investment. These are mainly in clean energy, agriculture, and green financing spaces. Opportunities exist most notably in 6 countries – Nigeria, Ghana, Kenya, Ethiopia, Egypt and South Africa.

These opportunities tend to be less technologically advanced (eg waste reduction vs carbon emissions reduction), are at different levels of maturity and mostly in areas where Africa possesses a strong natural resource advantage. The environmental impact potential within the opportunity pipeline spans a wide range of outcomes from carbon emissions reduction, to strengthened adaptation and resilience, to waste reduction.

The highest opportunity areas include:

Clean energy

| Investment opportunities | Countries |

|---|---|

| Green hydrogen | South Africa, Egypt, Morocco, Namibia |

| On-shore wind farm advisory | Egypt |

| On-shore wind farm project development | South America |

| Residential and Commercial & Industrial (C&I) solar systems | Nigeria and Kenya |

| Utility solar projects | South Africa and Egypt |

Agriculture

| Investment opportunities | Countries |

|---|---|

| Sustainable animal feed | Kenya |

| Tech-enabled micro storage | Kenya and Nigeria |

| Tech-enabled cold storage | Egypt |

Green financing

| Investment opportunities | Countries |

|---|---|

| Carbon credit generation (eg forestry, fuel switching) | Kenya, Tanzania, Namibia and DRC |

| Green bond issuance and advisory | South Africa and Egypt |

Green hydrogen production

This is expected to reach approximately 25% of global energy sources by 2050, with Africa having potential to take a significant share – especially in South Africa, Egypt, Morocco and Namibia. UK businesses are well placed to participate across the continent by providing capital to plants, as well as advisory services.

On-shore wind farm development

Wind energy is set to grow from 2 Gigawatts in 2013 to 80 Gigawatts in 2030, with opportunities in South Africa and Egypt in particular. The UK is a global leader in the sector and there is strong opportunity for UK businesses to further increase investment in Africa for setting up / scaling up wind farms.

Distributed solar energy solutions

Solar energy is poised to play an integral part in Africa’s electrification journey. The UK is well-positioned to invest in residential and Commercial & Industrial (C&I) solutions, especially in markets such as Nigeria and Kenya.

Utility solar project development

There is opportunity for UK firms to leverage their strong solar expertise to lead involvement in utility solar projects in countries such as South Africa and Egypt. UK investors can provide capital to set up and scale up utility solar projects to capitalise on the growing importance of solar in Africa’s total power mix and help to drive universal electrification.

Sustainable animal feed production

UK demand for sustainable feed (eg insect-based) is set to grow substantially in the next 30 years and Africa presents a good opportunity for investors. For instance, black soldier fly larvae, fed on agricultural waste, provide important feed for the aquaculture sector. This presents a good opportunity for UK investors to provide growth capital to local producers in countries such as Kenya.

Tech-enabled micro-storage

Urbanisation and population growth is driving demand for tech-enabled micro storage in markets such as Nigeria and Kenya, and rising demand for cold storage from the aquaculture sector in Egypt. UK investors can provide growth capital to businesses in these markets.

Carbon-credit generating projects

Projects in Africa can be much more cost efficient than in the UK, where the cost per tonne of carbon credit generation is 24 times higher than the global average. UK investors can finance such projects (eg forestry, fuel switching) in markets like Kenya, Democratic Republic of the Congo, Namibia and Tanzania.

Green bond issuance

The Green bond market could reach £10 to £15 billion by 2030 as demand for sustainable financing increases. Positive development in South Africa and Egypt can serve as a proof-of-concept. The UK leads the green bond market globally, and UK banks and advisories can support issuances in Africa.

Recommended solutions to boosting green business participation in Africa

- help UK investors to connect with high-potential African projects and businesses, accelerate trade schemes, and raise awareness of opportunities and success stories

- governments and firms could co-create project aggregation mechanisms and joint funding rounds to improve scale and risk mitigation, to address the small size nature of opportunities and markets in Africa

- multilateral organisations and Development Finance Institutions (DFIs) can explore low-cost local currency loans and affordable foreign exchange hedging products

- support knowledge exchange programmes and scalable pilot projects and offer technical assistance to African governments to help with policy and regulatory framework development

- UK businesses, incentivised by government, could invest in catalytic infrastructure (eg pipelines and grid infrastructure), to improve opportunity viability and unlock them at scale

Activating this opportunity pipeline has the potential to unlock sustainable gains in development impact across Africa, while also advancing the commercial interests of both African and UK businesses. Importantly, it would also play an important role in substantiating the UK’s ambitions to be a global leader in climate action.

To activate the pipeline, information sharing and targeted matchmaking for businesses, policy advocacy, technical assistance and catalytic investments (from firms, and potentially also by UK government) is needed to unlock opportunities.

This will help to increase trade and investment in the green sector. Initial successes will prove the value to more UK and African players of opportunities which generate positive environmental and social outcomes, and spur further deals organically. Growth Gateway will facilitate this through targeted information dissemination and business networking events engagement with other UK Government organisations providing export advice and finance, and through ongoing advisory support.

To find out more about Growth Gateway and learn how your business can get involved in these green UK Africa trade and investment opportunities, contact growthgateway@fcdo.gov.uk or visit our website at growthgateway.campaign.gov.uk.

See visualisation tool of the UK-Africa green trade and investment opportunities identified by the project.

Source article: UK government