FAQs

TFSA is a UK government funded trade initiative supporting growth in export through the provision of targeted solutions, including access to essential market information and tools to equip businesses to comply with standards and regulations across regional and global value chains, including to the UK. TFSA support and services focus on sectors with high participation in trade by women, and with significant production in rural areas, to promote inclusive economic growth.

TFSA is operational in the Southern African Customs Union (SACU) countries – Botswana, Eswatini, Lesotho, Namibia and South Africa – and Mozambique. These are also the countries with which the UK entered into an Economic Partnership Agreement (EPA) in January 2021.

The TFSA Trade and Information Hub, tfsouthernafrica.org, provides access to the latest information on export and trade for SACU+M businesses, features a wealth of tailored tools and resources, as well as guides on how to navigate essential tools to growing export trade. You can contact us through the Hub Contact Us page and follow us on our social media platforms (LinkedIn, Facebook & Twitter) @tradeforwardsouthernafrica.

The Trade and Information Hub is in English and Portuguese versions, and all training sessions aimed at Mozambican firms are interpreted in Portuguese.

TFSA was designed in consultation with a wide range of stakeholders, including the private sector, other development partners, and national governments to ensure that it is responsive to the needs of businesses and aligned to national development priorities. For example, the priority sector selection process was undertaken in reference to national sector strategies and prioritisation. In addition, the National Steering Committees in each country ensure continued national alignment.

Anyone can access the Trade and Information Hub and social media pages (LinkedIn,Facebook, Twitter) for free – all that is required is access to the internet. There are no costs associated to our training platform, the TFSA School of Export, which requires registration and login, but remains free to all users.

TFSA works primarily through business support organisations such as sector associations, trade promotion agencies and chambers of commerce rather than directly with individual firms to overcome barriers to export trade and address knowledge gaps.

TFSA does not provide direct financial assistance. Rather, it will make Short Term Technical Assistance (STTA) available to business support organisations through the provision of sector support initiatives that seek to expand trade and reach new markets. Firms can access these support initiatives through the selected business support organisations. There is an emphasis on providing outsized benefits to businesses/sectors that have a high participation of women. Firms should watch for upcoming STTA announcements in selected sectors on the TFSA Trade and Information Hub and seek to benefit from technical assistance offered by TFSA through local business support organisations

TFSA supports market linkages through online trade promotion events and access to its Trade and Information Hub to lead businesses to resources that can help them find suitable business contacts and other matchmaking support.

The majority of TFSA initiatives are geared toward ensuring women in trade benefit from information and technical support necessary to gain access to trade channels and meet essential market and regulatory requirements for their products. Our Trade and Information Hub has a dedicated Women in Trade section, and TFSA works directly through women-focused business support organisations to reach and support women in trade through special tailored events and training.

There are no special requirements for women owned businesses to access TFSA resources and support. TFSA will link women businesses and entrepreneurs to its network of business support organisations positioned to help women access new markets and expand existing trade channels.

TFSA aims to focus on supply chains that produce goods that can compete in regional and international markets. TFSA will help traders reach both regional and international markets by supporting compliance with market standards and demand preferences. In Mozambique, TFSA does work to strengthen the domestic tilapia market as a first step to moving towards export.

The Trade and Information Hub is designed to be simple, accessible, data-light and easy to use. We recognise that some of the resources that the Trade and Information Hub connects users to can be complex to use. We provide links to existing instructional videos or guides and produce others where none exist or more guidance is found to be necessary. All guides are accessible under the Resources section of the Trade and Information Hub.

TFSA will build the training capacity of selected business support organisations in each of the SACU+M countries. Strengthening these organisations will enable them to act as future Knowledge Centres on the utilisation of the resources of the Trade and Information Hub.

Technical expertise will be provided via Short Term Technical Assistance (STTA) facilitated by selected business support organisations to address identified non-tariff barriers (NTBs) in the selected priority sectors.

When selecting the five priority sectors, TFSA considered a number of criteria: an already significant level of export trade in the sector indicating good potential for growth; potential for addressing barriers to trade within TFSA’s mandate (training and building capacity to comply with standards); potential for interventions to benefit women; existing industry initiatives that TFSA can leverage and add value to; environmental impact – negative vs positive – of individual sectors; regional synergies allowing for maximised impact; and potential to alleviate poverty.

Annual, quarterly and monthly data is updated by ITC as and when it is available. Depending on the country, and multiple externalities such as the COVID pandemic, there can be lags in provision of data, particularly monthly and quarterly data. This may have affected the ability of countries to provide their data returns on time, though most annual data is up to date for 2020.

Data can be downloaded in Excel, Word or Notepad text files and can also be printed.

Much of the data and tools are available without needing to register and log on. However, the full functionality and data above the 4-digit level of the Harmonised System of customs classification (HS) can only be accessed when you register and logon. It remains free for users in low- and middle- income countries

Much of the data and tools are available without needing to register and log on. However, the full functionality and data above the 4-digit level of the Harmonised System of customs classification (HS) can only be accessed when you register and logon. It remains free for users in low- and middle- income countries

The ITC tools can be accessed for free by registering on the following up link: https://marketanalysis.intracen.org/en

The tools are linked on the TFSA Trade and Information Hub on the home page https://tfsouthernafrica.org where they are presented in sequence for easy reference for each step of the process of researching export possibilities.

You can register and login for free if you are a user in low- and middle-income countries. For terms and conditions on use of the information and data, it is advisable to confirm your intended use is compliant. Visit https://mas-admintools.intracen.org/accounts/TermsConditions.aspx for more information.

Please use this link: https://marketanalysis.intracen.org/en to register.

It does not require any subscription, by way of any fee, for users in low- and middle-income countries. However, for full access to all facilities and data at detailed in the HS (Harmonised System) it requires registration, please use this, https://mas-admintools.intracen.org/accounts/Registration.aspx for more information.

Some products, generally those which are traded in smaller volumes, are not specifically allocated a separate standalone classification at global level but fall into a broader grouped category. So for example under the “fruit” heading, some strongly traded fruits have specific codes eg oranges, apples. Less traded products are then grouped as “other”. On Trademap it is possible to use the “Advanced Search” function to find the group category at the global 6 digit level into which such more specialised produce would fall. Click here to run a search on the Trade Map system.

While the HS system is standard across all countries globally to 6 digit level, countries sometimes do individually further categorise specialised products if trade in a particular specialised product is traded more in their economies. It is possible to use the advanced search facility to identify the tariff line that a particular country might have classified at more than 6 digit level:

Yes the software is tailored, workshop is conducted to determine exactly what the company requirements are and adjust / build accordingly.

We can provide you with more information on X-Border and the cost breakdown. Our details are info@sitcsa.com or +27 (012) 654 1419/8929

The https://www.trademap.org/Index.aspx facility mostly covers producers, importers, distributors for business to business aims globally. Sometimes that includes larger retailers though not usually the smaller retailers. This guide https://www.cbi.eu/market-information/apparel/finding-buyers provides enormously useful guidance with links to many sources of leads to connect assist in identifying buyers and retailers in the EU and UK. Under that there is an accessory specific guide https://www.cbi.eu/market-information/apparel/fashion-accessories/europe.

The data relates to products traded between countries. The data does not cover in-market consumption.

Trade Forward Southern Africa does not organise any trade shows.

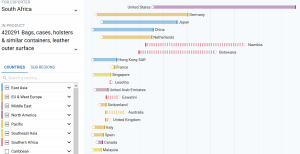

It appears from the data that the current trade in leather bags from Lesotho is not large enough to register in the global trade data in the tools so the next most relevant would be to track the trade opportunity in the category for your neighbouring exporters in South Africa which would be a good indicator of potential markets also for producers in Lesotho:

Shipping costs from Africa often are a significant cost for our exporters. Unfortunately, that is likely to endure for some time until volumes of trade bring economies of scale in transport costs. Until then the best way to reduce those costs is by shopping around for best prices amongst logistics providers and negotiating rates with them.

One of the factors that determines export potential is the existing level of current exports from the supplier country globally as well as to the target market. Changing the supplier country thus will change those trade numbers and therefore also the market potential from one country will be different to the market potential of another supplier country. Also taken into consideration is the physical distance of a supplier country from target countries.