The global market for cashews is booming, but the African countries growing more than half the world’s supply aren’t cashing in, an UNCTAD report says, due to their lack of processing industries.

Between 2000 and 2018, world trade in raw cashew nuts more than doubled to 2.1 billion kilograms, and African producers – led by Côte d’Ivoire – accounted for almost two-thirds of the growth.

But the continent’s farmers and exporters get only a fraction of the final retail price, according to the report, Commodities at a Glance: Special issue on cashew nuts.

“Countries that grow cashews but don’t process them at a significant scale retain only a small share of the value created as the nut travels from the farm to store,” said Miho Shirotori, who leads UNCTAD’s work on trade negotiations and commercial diplomacy.

“African farmers, exporters and workers are missing out on a wealth of opportunities,” Ms. Shirotori said.

How Africans are missing out

Cashews thrive in the tropical climates of 20 western and eastern African nations, where about 90% of the raw cashew nuts traded in the global market are grown. Behind Côte d’Ivoire, the main producers are Tanzania, Nigeria, Benin, Guinea-Bissau, Mozambique and Ghana.

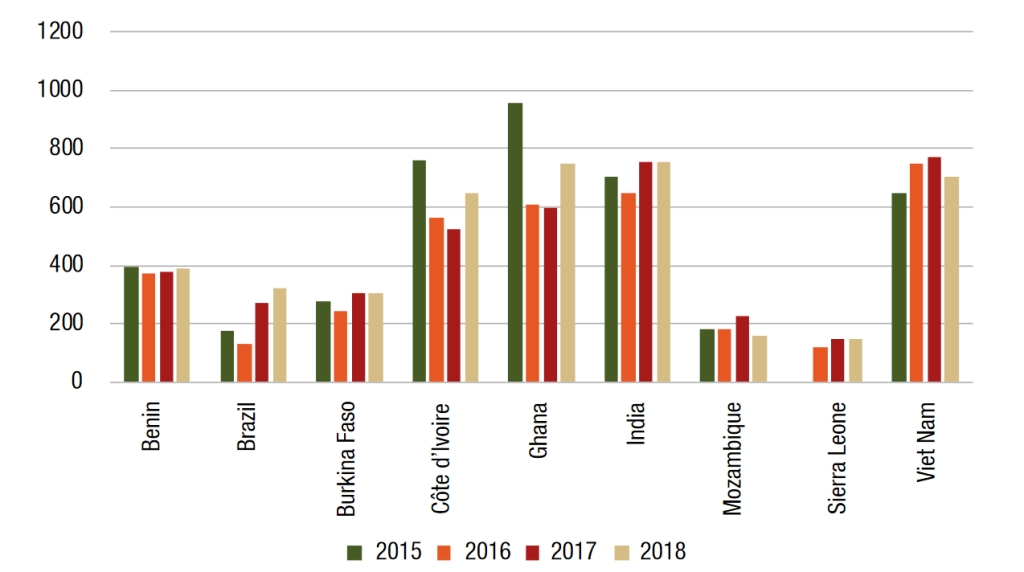

But less than 15% of the continent’s nuts are deshelled on African soil. The rest is exported mainly to Asia, where 85% of the world’s cashews are deshelled, which adds value to the commodity. Just two Asian nations – India and Viet Nam – accounted for about 98% of the world’s raw cashew imports between 2014 and 2018.

Even more value is added in Europe and North America, where 60% of traded kernels are roasted, salted, packaged and consumed as a snack or an ingredient in a drink, bar or other product.

The cost of limited processing

Although it’s challenging to calculate how much Africans are losing, the report provides indicative calculations.

In 2018, for example, the export price of cashew kernels from India to the European Union was about 3.5 times higher than what was paid to cashew farmers in Côte d’Ivoire – a 250% difference in price.

And after secondary processing in the EU, the price of the cashew kernels was about 2.5 times higher than when exported from India – and about 8.5 times more than when they left the farm in Côte d’Ivoire.

“This shows the potential for value creation in African cashew-growing countries, 14 of which are classified as ‘least developed’,” Ms. Shirotori said. “And value creation can lead to better wages for workers and more money for the local economy.”

Cashews can help reduce poverty

The report highlights the potential for cashews to contribute to the UN Sustainable Development Goals, particularly the one on poverty reduction.

“Since production typically takes place on smallholdings in rural areas, there is a direct link between value addition in the cashew sector and the achievement of poverty reduction,” the authors write, highlighting that cashews are a source of income for an estimated 3 million smallholder farmers in Africa.

Although cashews’ untapped poverty reduction potential is greatest in Africa, it’s also valid for the other nations where it’s grown in Asia and Latin America and the Caribbean.

The report highlights that all 46 countries producing cashew nuts “on a significant scale” are developing economies, 18 of which are classified as “least developed countries” (LDCs).

“Africa isn’t the focus of the report,” said Stefan Csordas, the report’s lead author. “But given that the continent produces more than half of global supply and is where 14 of the LDCs producing cashews are located, Africa features prominently in the analysis.”

A dozen of the other countries growing the nut are Asian (four are LDCs) – accounting for 43% of global production – and 14 are in the Latin American and the Caribbean region, which produces 5% of the world’s supply.

New market opportunities

A range of market trends mentioned in the report open opportunities for African processors. These include global consumer’s growing taste for healthier snacks and their increased preference for food products that are more environmentally friendly and ethically sourced.

“The traceability, transparency and sustainability of food supply chains is becoming increasingly important for consumers and suppliers,” the report says, highlighting that this could benefit African processors, who source their nuts locally rather than through long supply chains.

African processors that can meet the increasingly strict food quality and safety standards in global markets, could take advantage of growing demand for organic products, which in the EU grew, for example, by 121% between 2009 and 2019.

Better policies needed

While the backbone of the African cashew industry must be a stable supply of high-quality raw nuts, the report says processors also need a policy environment “that enables them to operate with competitive transformation costs and facilitates access to the main export markets.”

Policies aimed at supporting the cashew sector in African nations must therefore consider the entire cashew value chain: production, processing and trade. According to the report, this would include:

- Ensuring farmers have access to quality seedlings, technological know-how and market information.

- Increasing training for farmers on entrepreneurship and farm management, including harvest and post-harvest practices.

- Supporting public research that helps identify agricultural practices and technologies that work best in local environmental and economic conditions.

- Improving rural infrastructure, including secondary roads, to better connect cashew farms and processing sites.

- Facilitating market entry through technical skills development and better access to market information.

- Strengthening capacity among cashew processors to meet quality standards in prospective foreign markets.

- Promoting the development of cashew byproducts, such as beverages based on cashew apples, which are normally discarded as waste.

- Fostering cooperation between cashew-growing regions to improve market stability, limit supply bottlenecks and reduce incentives for cross-border smuggling.

Such policy action and support would ultimately strengthen African countries’ productive capacities – the productive resources, entrepreneurial capabilities and production linkages that determine an economy’s capacity to produce and add value to goods and services.

UNCTAD Productive Capacities Index tracks how well countries have developed their productive capacities, allowing policymakers to trace their country’s performance over time.